how do you calculate cash flow to creditors

Your most regular cash expenses will probably be rent a. This is a negative cash flow.

Free Cash Flow Net Income Depreciation Change in Working Capital Capex.

. Is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year. Operating Cash Flow Net Income - Non-Cash Expenses Changes in Assets and Liabilities. Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital.

Free Cash FlowNet Operating Profit After Taxes Net Investment in Operating CapitalwhereNet Operating Profit After TaxesOperating Income 1 - Tax Rateand whereOperating IncomeGross. Ad QuickBooks Financial Software. Beginning cash is of course how much cash your business has on hand todayand you can pull that number right off your Statement of Cash Flows.

The Cash Flow to Creditors equation reflects cash flow generated from periodic profit adjusted for depreciation a non-cash expense and taxes which create a cash outflow. If a company has an operating income of 30000 5000 in taxes zero depreciation and 19000 working capital its operating. Basic Formula The basic formula for operating cash flow is earnings before interest and taxes or EBIT plus depreciation and minus taxes.

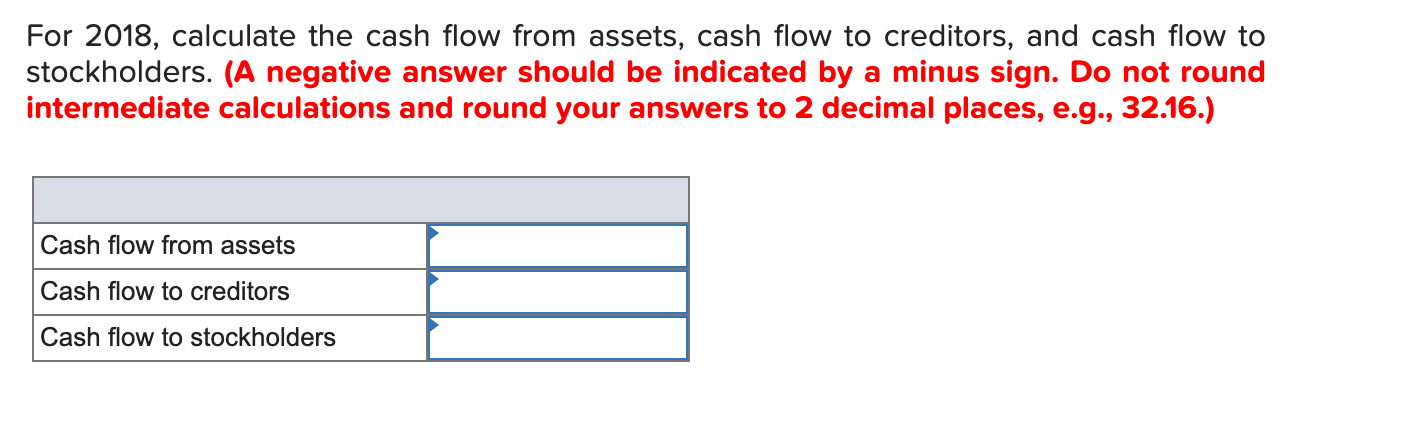

Calculating Cash Flows Calculating Owners Equity Net Working Capital Fixed Assets Long Term Debt and Cash Flow to Creditors Direct and indirect methods of cash flow from operations Cash flow to creditors Cash flow to stockholders Financial ratios for Just Dew It Braam Fire. 18500 -15000 -30000 -26500. Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending Cash.

Operating cash flow is the earnings before interest and taxes plus depreciation minus taxes. Creditors have interest in your operating cash flow when deciding whether you are well-positioned to take on additional debt. Free Cash Flow 227 million 32 million 65 million 101 million.

Bettys Blooms Flower Shops had a -26500 cash flow from assets from July to December. Nd your credit card andor loan payments. The statement of cash flows acts as a bridge between the.

Cash Flow and Average Collection Period The average collection period is used a few different ways to measure cash flow performance. Since the company redeemed long-term debt the new borrowing is negative. After your columns are totaled subtract your costs from your revenue to get your cash flow.

The cash flow report is important because it informs the reader of the business cash position. This shows they spent more than they earned in. It also provides lenders and creditors with immediate insight into a business current financial health.

Therefore the company generated operating cash flow and free cash flow of 221 million and 93 million respectively during the year 2018. Operating Cash Flow Formula. 4 Formulas to Use Cash flow Cash from operating activities - Cash from investing activities Cash from financing activities Cash flow forecast Beginning cash Projected inflows Projected outflows Operating cash flow Net income Non-cash expenses Increases.

Cash flow is the amount of cash or cash-equivalent which the company receives or gives out by the way of payment to creditors. 93 of small business owners are constantly leaking money on useless and unnoticed things. Calculate the total interest paid.

If the number is more than zero you have positive cash flow while if the result is less than zero you have negative cash flow. Operating Cash Flow Net Income All Non-Cash Expenses Net Increase in Working Capital. So the cash flow to creditors is.

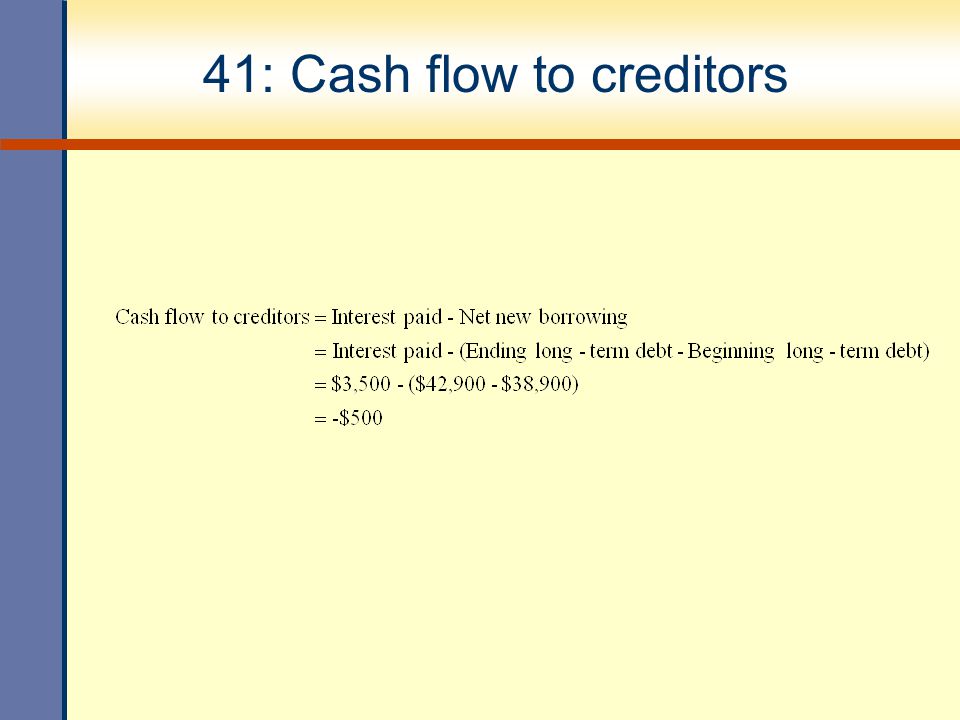

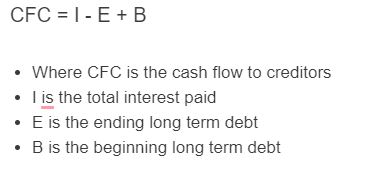

Cash flow to creditors Interest paid Net new borrowing Cash flow to creditors 7900 3800 Cash flow to creditors 11700 c. The cash flow to creditors is the interest paid plus any new borrowing. This presentation begins with net income or loss with subsequent additions to or deductions from that amount for non-cash revenue and expense items resulting in cash provided by operating activities.

How to Calculate Cash Flow. A positive cash flow is good for the company as it determines financial success and a negative cash flow says otherwise. Put them each on individual lines.

Heres how to calculate the cash flow from assets. Next determine the beginning long term debt. The simple formula above can be built on to include many different items that are added back to net income such as depreciation and amortization as well as an increase in accounts receivable inventory and accounts payable.

How to Calculate Cash Flow. Add the two together to get a total cash balance of 13000. Add up all the incoming revenue and then add up all expenses.

Example of Cash Flow from Assets. A business earns 10000 during the measurement period and reports 2000 of depreciation. Ad Get 3 cash flow strategies to stop leaking overpaying and wasting your money.

Cash flows for Managerial Accounting Statement of Cash Flows. Determine the amount of long term debt at the end of the period. Determine the amount of long term debt at.

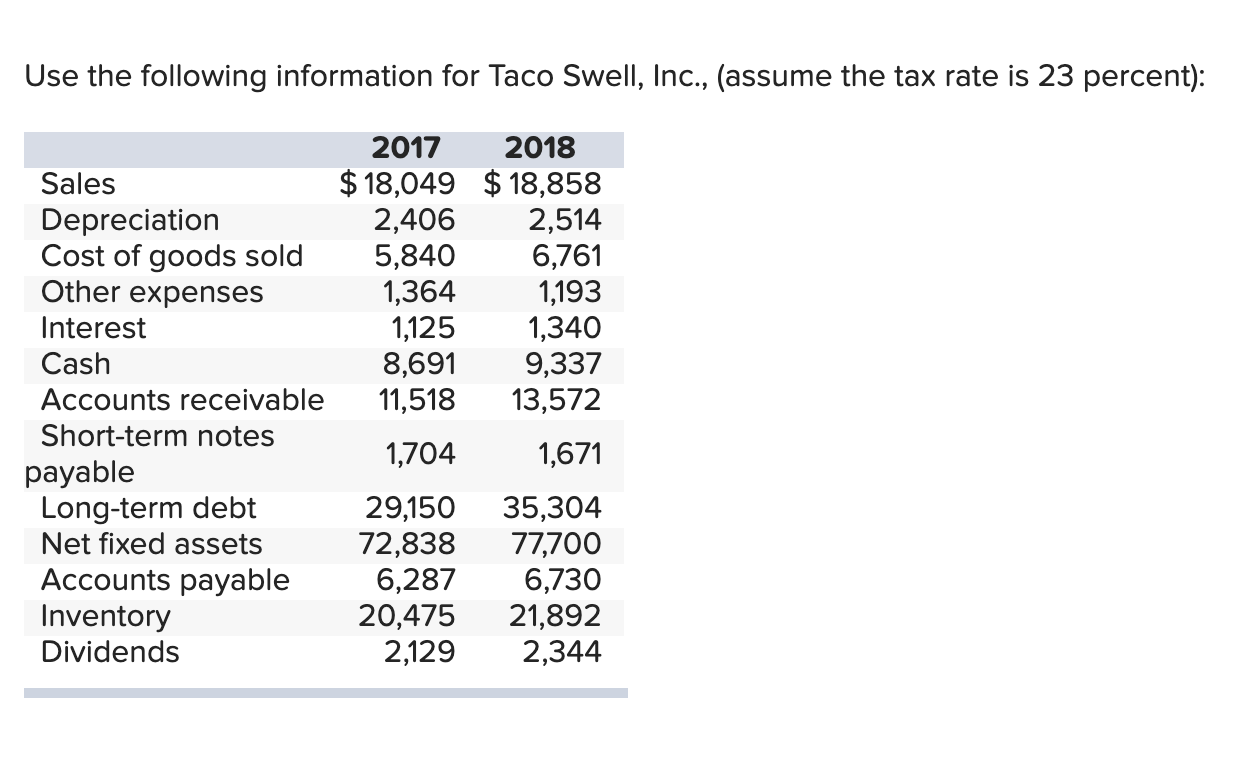

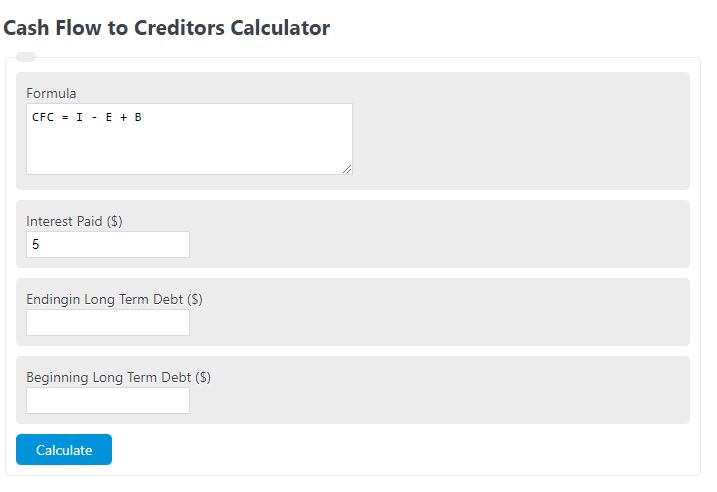

Project inflows are the cash you expect to receive during the given time period. It also experiences an increase of 30000 of accounts receivable and an increase of 10000 in inventory versus an increase of 15000 in accounts payable. Cash Flow From Creditors Example First determine the interest paid.

Working method of operating cash flow is. Next determine the ending long term debt. Calculating OCF offers full transparency into a companys true profitability and is one of the purest measures of cash sources and uses.

Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. This means that you can monitor changes in cash using the cash flow statement and the impact on. To learn more about calculating business cash flow keep reading.

Rated the 1 Accounting Solution. Generally speaking companies want to minimize their average. The calculation of cash flow for operating activities is usually compiled using the indirect method of presentation.

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com

Financial Statements Taxes And Cash Flow Ppt Video Online Download

Financial Statements Taxes And Cash Flow Ppt Video Online Download

Operating Cash Flow Formula Calculation With Examples

Training Modular Financial Modeling Annual Forecast Model Debtors Creditors Debtors Modano

Cash Flow To Creditors Calculator Finance Calculator Icalculator

Solved Use The Following Information For Taco Swell Inc Chegg Com

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Cash Flow Statement Overview A Simple Model

Modules Guide Creditors Financial Statement Impacts Modano

Cash Flow To Creditors Calculator Calculator Academy

Chapter 2 Financial Statements Taxes And Cash Flow

Cash Flow To Creditors Calculator Calculator Academy

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com